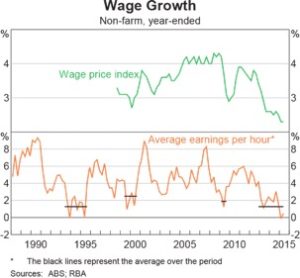

“Labour cost pressures remain weak (Graph 5.7). The wage price index (WPI) increased by 0.6 per cent in the June quarter and by 2.3 per cent over the year – the lowest annual outcome since the index was first published in the late 1990s.”

This is a direct quote from the RBA’s November Price and Wage Developments publication. For those of you into chart porn, “Graph 5.7” is included below.

Government also relies on healthy wage growth numbers to fatten their take of revenue. It’s called bracket creep and it avoids the government having to implement the electoral equivalent of leprosy – tax increases. With wage growth at record lows and a collapse in commodities prices, whichever government is in power will need to address the deteriorating tax take.

But I digress…you know how we’ve just recently undergone a massive property boom? The above information should give you pause for concern – although, as is always the case, there is an upside to all of this but more on that later.

One of the cool aspects of having a regulator control the market is that it can help to smooth bubbles – which appears to be what they have done in Sydney.

How have they achieved this? A communication was sent to all banks around this time last year telling them to limit their growth in housing finance to 1.1x system growth. This had the effect of limiting the supply of finance (with levers such as LVR and price as well as tweaking their servicing criteria). That’s why they have acted to increase rates when the central bank is talking about easing.

I (begrudgingly) applaud them for doing what they’ve done. But if you’re a potential property acquirer waiting for the market to cool you may want to consider that the regulator is still allowing the property lending market to grow by 10% each year. With the exception of a few outlying suburbs, demand still outstrips supply (although this will change with the massive amount of construction currently underway).

I’m not saying that prices won’t fall, I’m just skeptical of expectations of large asset price falls when unemployment has a 5 in front of it. Recent auction clearance rates results also point towards a tempering of growth rather than a crash. For the chart junkies, see Graph 3.3 below (sourced from the RBA November 2015 Domestic Economic Conditions report):

Now, the upside – and this mainly applies if you’re an owner of property.

If we’re at the lowest level of wage growth since they started measuring the data and unemployment (if the ABS numbers are accurate) is trending down, can one assume that this is as bad as it gets (or close to it)? Assuming, negative wage growth will occur if unemployment climbs dramatically (and I’m not an economist so take that with a large grain of salt) and the unemployment rate is flat to trending down, is it safe to assume that we are at (or near the bottom of) the current wage growth cycle?

If that’s the case – and you’re managing your debt repayments now – then you will breathe a sigh of relief if/when wages growth recovers to a more normalised number (trend). However, it’s also likely then that the RBA will increase rates then.

Hey, don’t take my word for it, here’s what the RBA said in its November Economic Outlook:

“Growth in household consumption is projected to increase to be a bit above average from 2016, consistent with the forecasts from the August Statement. Low interest rates and further growth in employment are expected to continue to support a pick-up in household demand, and the household saving ratio is expected to decline gradually. The high level of residential building approvals since the start of the year is likely to translate into further increases in dwelling investment, albeit at a gradually moderating rate.”

In the meantime, keep washing those dishes.