We’ve seen lots and lots of digital space dedicated to what interest rates are doing this week. One minute the Aussie dollar races above $0.79 against the USD — after a slight change in the RBA minutes — and the frenzy of predictions that the RBA will move rates up has us in a lather.

Just as we’re reaching to wipe the foam from our collective mouths, the RBA’s deputy Governor hoses us all down and announces not to read too much into that change. See his comments here.

The RBA poured cold water over changes in its minutes.

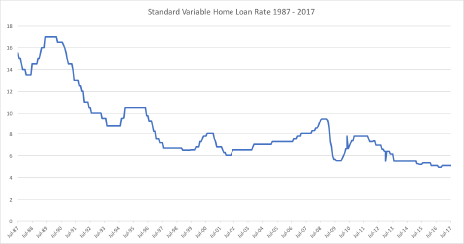

In the 30 years since July 1987 the standard variable home loan rate has fluctuated quite a bit. I chose this period because that’s the most common tenure for a home loan these days. Have a look at the chart below and you can see that the last 20 years (since 1997) interest rates have been quite stable (a few peaks and troughs not withstanding).

The 30 year SVR chart shows that rates have generally been stable over the last 20 years (with a few peaks and troughs through the GFC).

I’m choosing to ignore the pre 1997 period as that’s a whole other article — the Australian economy had been transitioning for the previous ten years from an agricultural/resource economy to a services based one. Also, in that period compulsory superannuation was introduced — which boosted the liquidity available to the local economy by trillions. In any event rates were above 17% briefly. Massive pain was felt of course and we had double digit everything (unemployment, inflation and interest rates). The resulting recession (the one we had to have according to the then prime minister) meant that rates were almost in free-fall thereafter. The real period of interest in the above chart is the period from July 2006 when the Standard variable rate (or “SVR”) climbed from 7.3% to 9.45% by September 2008. Yes, people pulled their belts in during this period and many chose to fix when rates started to fall. With the benefit of hindsight, that was a mistake.

Many chose to fix when rates started to fall…that was a mistake.

Look how quickly rates fell to 5.55% by September 2009 (by almost 4%). If you fixed then, you may have done better than those that fixed a couple of years earlier but the SVR is now at 5.1%. We’re still seeing clients that had fixed for 5 or 7 years just coming off their fixed rates in the 7.x%. Now I know they bought certainty with a fixed rate but — again, with the benefit of hindsight — they paid away over 2% (minimum) over the term of their fixed rates. On a $500k loan that’s roughly an additional $50k in repayments for a 5 year fixed rate. I’m yet to meet anyone that can accurately predict what rates will do over the next 30 years. So next time you’re making up your mind whether or not to fix rates, remember the chart above. By all means ask your banker or your broker but I guarantee you they will be guessing or worse steering you towards a product that benefits them rater than you. If a broker ever tells you to fix for two years, run. Some brokers try and lock you in to ensure that their commission is not clawed back should you decide to refinance within two years.

I’m yet to meet anyone that can accurately predict what rates will do over the next 30 years.

I have fixed once but have learned my lesson. My view: unless you can successfully pick and predict the peaks and troughs of interest rates fixing can lock you into something that can quickly become unattractive. Then, when variable rates fall you develop rate envy. So the next time a client asks me what I think rates will do, I will pull out this chart and show them why I don’t know.